Smart strategies to turn your property into long-term wealth

Florida is more than just a vacation destination — it’s a powerhouse market for real estate investment. With strong rental demand, steady appreciation, and favorable tax conditions, Florida continues to attract savvy U.S. buyers who want their properties to work for them.

Here’s how to maximize your return on investment (ROI) when buying real estate in the Sunshine State.

1. Understand What ROI Means in Real Estate

ROI = (Net Profit / Total Investment) x 100

To get a good ROI, you want:

- Solid monthly cash flow (for rentals)

- Appreciation over time

- Tax benefits and depreciation

- Minimal maintenance or vacancy costs

Every decision — from location to loan type — can affect your return.

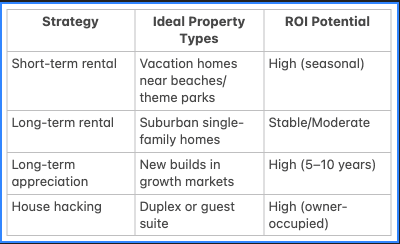

2. Choose the Right Property Type

Work with your agent to compare options that fit your risk tolerance and lifestyle goals.

3. Location, Location, ROI

Some Florida markets are hotter than others for ROI:

- Orlando/Kissimmee: Ideal for short-term rentals and tourism traffic

- Tampa Bay: Strong job market and urban growth

- Cape Coral/North Port: Affordable with rising appreciation

- Gainesville: Steady rental demand from students and medical professionals

- Palm Coast: Up-and-coming for long-term holds

Look for:

- Low property taxes

- Low HOA/CDD fees

- Strong rental comps and local growth trends

4. Don’t Overlook Expenses

To get true ROI, you need to subtract all your costs, including:

- Mortgage payment

- Property taxes

- Insurance (including flood/wind)

- Maintenance and repairs

- Property management (if outsourced)

- HOA fees

- Vacancy periods

Smart investors plan for 5–10% in maintenance reserves annually and keep at least 2 months’ worth of expenses in savings.

5. Add Value Through Renovation

Buying a home with “good bones” and updating it smartly can significantly boost ROI. Consider:

- Upgrading kitchens and bathrooms

- Adding a guest suite or ADU

- Improving curb appeal and landscaping

- Converting garage/attic space into income-producing units

Look for homes in transitional neighborhoods where value is rising, but prices are still accessible.

6. Use Tax Advantages to Your Benefit

Real estate investors enjoy several tax benefits:

- Depreciation deductions

- Mortgage interest write-offs

- 1031 exchange options to defer capital gains

- Cost segregation studies for high-value properties

Talk to a CPA familiar with real estate to maximize your deductions.

Final Thoughts

Florida real estate offers more than just sunshine — it offers income, appreciation, and financial leverage when done right. By making smart decisions about what, where, and how you buy, you can build wealth and passive income for years to come.

Ready to Start Investing in Florida Real Estate?

Let’s create a custom plan based on your financial goals, preferred property types, and local market data.

➡️ Contact us for your free Florida Real Estate Investment Strategy Session.